Undervalued Small Caps With Insider Activity To Consider In March 2025

Over the last 7 days, the United States market has experienced a 2.5% drop, yet it remains up by 13% over the past year with earnings projected to grow by 14% annually. In such dynamic conditions, identifying small-cap stocks with insider activity can offer unique insights into potentially promising opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First United | 11.1x | 3.0x | 40.84% | ★★★★★☆ |

| First Mid Bancshares | 11.6x | 2.9x | 35.88% | ★★★★★☆ |

| Array Technologies | NA | 0.9x | 45.41% | ★★★★★☆ |

| S&T Bancorp | 11.7x | 4.0x | 37.76% | ★★★★☆☆ |

| Innovex International | 8.5x | 1.8x | 42.80% | ★★★★☆☆ |

| Citizens & Northern | 12.7x | 3.1x | 41.16% | ★★★☆☆☆ |

| Arrow Financial | 15.2x | 3.3x | 39.20% | ★★★☆☆☆ |

| Columbus McKinnon | 49.6x | 0.5x | 47.20% | ★★★☆☆☆ |

| Union Bankshares | 14.8x | 2.8x | 31.15% | ★★★☆☆☆ |

| Franklin Financial Services | 15.1x | 2.4x | 23.65% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

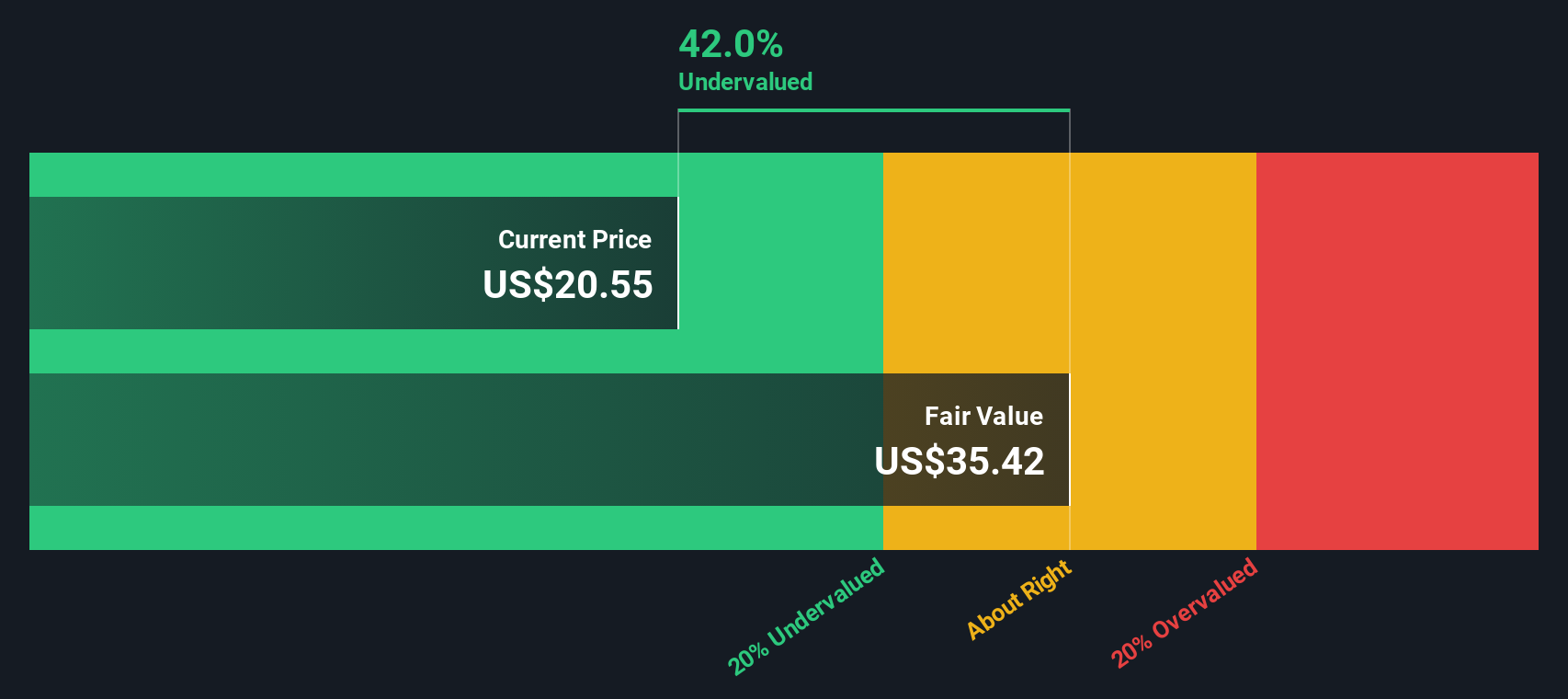

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Civista Bancshares operates as a financial holding company providing community banking services, with a market capitalization of approximately $0.25 billion.

Operations: Civista Bancshares generates its revenue primarily from banking activities, with a recent quarterly revenue of $149.09 million. Operating expenses have consistently increased, reaching $112.52 million in the latest quarter, driven mainly by general and administrative costs totaling $93.99 million and sales & marketing expenses of $2.09 million. The net income margin has shown variability over time, recently standing at 20.80%.

PE: 10.6x

Civista Bancshares, a smaller U.S. financial institution, recently reported fourth-quarter net interest income of US$31.36 million, slightly up from the previous year. However, annual net income dropped to US$31.68 million from US$42.96 million in 2023. Despite this dip, insider confidence is evident with recent executive changes and a dividend increase to $0.17 per share for February 2025 payouts. Earnings are projected to grow annually by 11.62%, suggesting potential for future value appreciation.

- Click to explore a detailed breakdown of our findings in Civista Bancshares' valuation report.

Explore historical data to track Civista Bancshares' performance over time in our Past section.

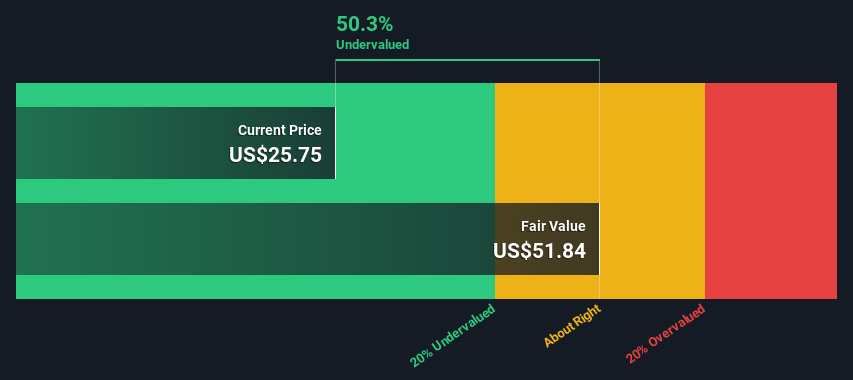

PennyMac Mortgage Investment Trust (NYSE:PMT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: PennyMac Mortgage Investment Trust is a real estate investment trust that focuses on mortgage-related assets and operates through segments including correspondent production, credit sensitive strategies, and interest rate sensitive strategies, with a market capitalization of approximately $1.07 billion.

Operations: The company generates revenue primarily from Credit Sensitive Strategies ($123.68 million), Interest Rate Sensitive Strategies ($112.31 million), and Correspondent Production ($90.49 million). Over recent periods, the gross profit margin has shown variability, reaching a peak of 85.03% in Q3 2024 and dipping to 45.56% in Q1 2023, indicating fluctuations in cost management efficiency relative to revenue generation.

PE: 10.7x

PennyMac Mortgage Investment Trust, a player in the mortgage investment sector, has recently attracted attention due to its insider confidence, with insiders purchasing shares over the past months. Despite reporting a decrease in net income to US$161 million for 2024 from US$200 million in 2023, they maintain an attractive dividend yield with recent declarations for preferred shares. Their recent US$150 million fixed-income offering underscores strategic financial maneuvers. Earnings are projected to grow annually by 6.27%, suggesting potential future value amidst current challenges.

PROG Holdings (NYSE:PRG)

Simply Wall St Value Rating: ★★★★★☆

Overview: PROG Holdings operates in the consumer finance industry, primarily through its Progressive Leasing segment, with a market cap of approximately $1.43 billion.

Operations: The primary revenue stream for the company is Progressive Leasing, contributing significantly to its overall income. The gross profit margin has shown a notable upward trend from 24.69% in 2020 to 34.20% by the end of 2024, indicating improved cost management or pricing strategies over this period. Operating expenses are primarily driven by general and administrative costs, which have remained relatively stable around $426 million in recent periods.

PE: 6.0x

PROG Holdings, a smaller company in the U.S. market, recently saw insider confidence with Independent Director Douglas Curling purchasing 10,000 shares for US$298,800. This move increased their shareholding by 31%. The company announced a quarterly dividend of US$0.13 per share and expects full-year revenues between US$2.52 billion to US$2.59 billion with net earnings up to US$133 million in 2025. Despite high debt levels from external borrowing, the firm completed a significant buyback program repurchasing over 48% of its shares since November 2021 for nearly US$941 million.

- Unlock comprehensive insights into our analysis of PROG Holdings stock in this valuation report.

Evaluate PROG Holdings' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 55 Undervalued US Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal