What Analysts Are Saying About Paycom Software Stock

In the latest quarter, 8 analysts provided ratings for Paycom Software (NYSE:PAYC), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 7 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

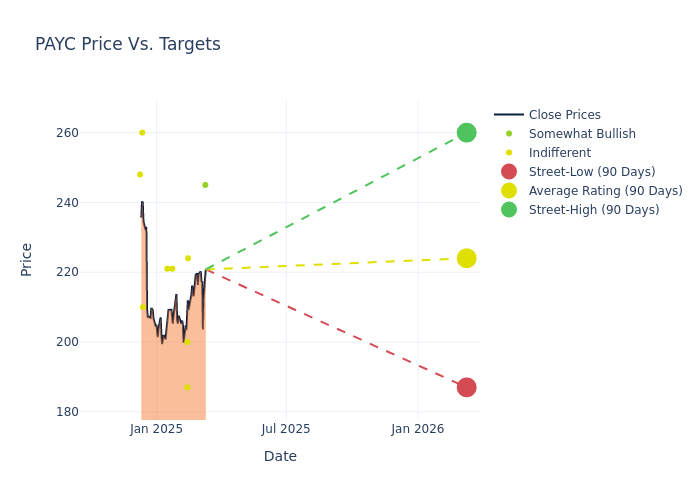

Analysts have recently evaluated Paycom Software and provided 12-month price targets. The average target is $221.0, accompanied by a high estimate of $260.00 and a low estimate of $187.00. Surpassing the previous average price target of $205.86, the current average has increased by 7.35%.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Paycom Software. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Celino | Keybanc | Announces | Overweight | $245.00 | - |

| Arvind Ramnani | Piper Sandler | Raises | Neutral | $224.00 | $191.00 |

| Mark Murphy | JP Morgan | Raises | Neutral | $200.00 | $185.00 |

| Brad Reback | Stifel | Lowers | Hold | $187.00 | $215.00 |

| Raimo Lenschow | Barclays | Lowers | Equal-Weight | $221.00 | $229.00 |

| Steven Enders | Citigroup | Lowers | Neutral | $221.00 | $234.00 |

| Siti Panigrahi | Mizuho | Raises | Neutral | $210.00 | $190.00 |

| Daniel Jester | BMO Capital | Raises | Market Perform | $260.00 | $197.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Paycom Software. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Paycom Software compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Paycom Software's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Paycom Software analyst ratings.

Discovering Paycom Software: A Closer Look

Paycom is a fast-growing provider of payroll and human capital management software primarily targeting clients with 50-10,000 employees in the United States. Paycom was established in 1998 and services about 19,500 clients as of 2023, based on parent company grouping. Alongside its core payroll software, Paycom offers various HCM add-on modules, including time and attendance, talent management, and benefits administration.

Paycom Software: Delving into Financials

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Paycom Software displayed positive results in 3 months. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 13.63%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Net Margin: Paycom Software's net margin excels beyond industry benchmarks, reaching 22.99%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Paycom Software's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.47%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Paycom Software's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.43% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Paycom Software's debt-to-equity ratio is below the industry average. With a ratio of 0.05, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal