Maui Land & Pineapple Company, Inc.'s (NYSE:MLP) Shares May Have Run Too Fast Too Soon

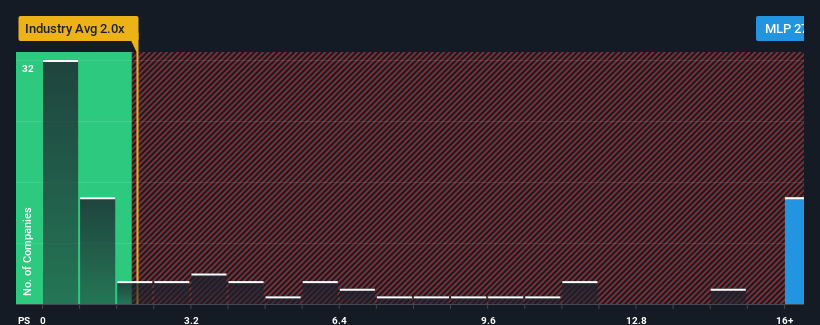

Maui Land & Pineapple Company, Inc.'s (NYSE:MLP) price-to-sales (or "P/S") ratio of 27.8x may look like a poor investment opportunity when you consider close to half the companies in the Real Estate industry in the United States have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Maui Land & Pineapple Company

How Has Maui Land & Pineapple Company Performed Recently?

With revenue growth that's exceedingly strong of late, Maui Land & Pineapple Company has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Maui Land & Pineapple Company's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Maui Land & Pineapple Company would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The latest three year period has also seen a 5.6% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Maui Land & Pineapple Company's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Maui Land & Pineapple Company's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Maui Land & Pineapple Company currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Maui Land & Pineapple Company, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Maui Land & Pineapple Company, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal