Amphenol (NYSE:APH) Faces Patent Infringement Allegations From Credo Involving Active Electrical Cables

Amphenol (NYSE:APH) saw its shares decline by 2.91% last week, coinciding with Credo Technology Group's legal actions alleging patent infringement against several companies, including Amphenol. This legal challenge arises amid an uneasy broader market environment, where indices like the S&P 500 and Nasdaq Composite fell 1.2% and 1.7%, respectively, influenced by weak earnings guidance from major tech firms such as Adobe, which dropped due to a disappointing outlook. The broader market showed worries over economic slowdown and mixed sentiments about inflation after fresh Producer Price Index data. While economic policies from the current administration sparked uncertainty among investors, high volatility continued to affect market dynamics, impacting various sectors. Amphenol's stock performance, therefore, reflects the combined pressure of specific legal uncertainties and broader market weaknesses, characteristic of this challenging trading period.

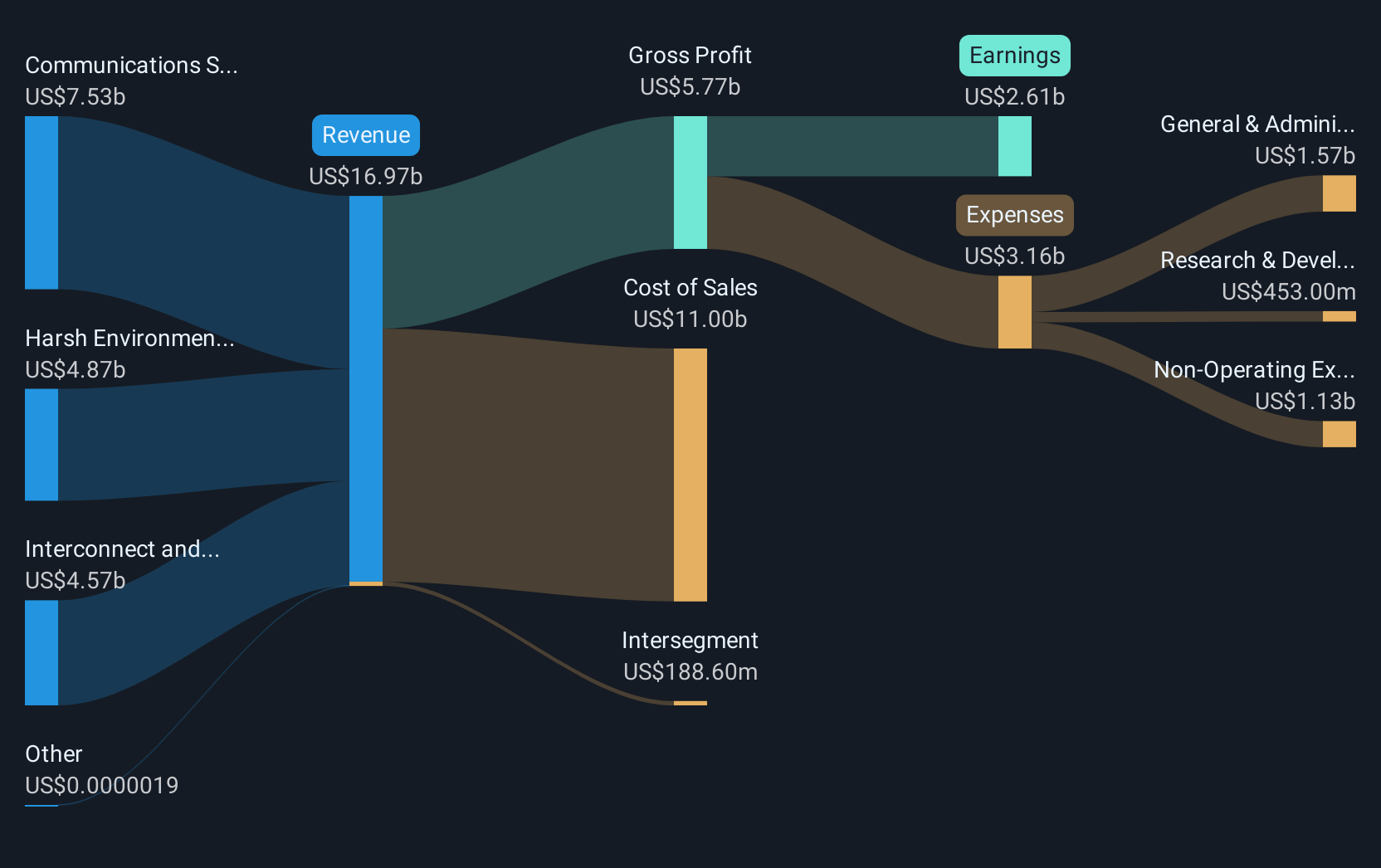

Examine Amphenol's earnings growth report to understand how analysts expect it to perform.

Over the past five years, Amphenol's total shareholder returns reached a substantial 284.55%, reflecting robust financial performance. The growth in earnings by 14.9% annually and a notable 25.7% acceleration in the past year contributed significantly to this return. Amphenol's stock also performed favorably compared to the US Electronic industry, which returned just 2.5% in the last year. In particular, Amphenol's net profit margins have improved, with current margins at 15.9%, up from last year's 15.4%.

Corporate actions have played a critical role in shareholder returns. The company has actively repurchased shares, with transactions totaling US$219.57 million in recent months. This effort, alongside impressive earnings reports—such as sales increasing to US$15.22 billion in 2024—underpins the company's strong financial health. Additionally, a significant 50% increase in the quarterly dividend in 2024 underscores Amphenol's commitment to returning value to its shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal