FactSet Research Systems (NYSE:FDS) Names Kevin Toomey Head Of Investor Relations

FactSet Research Systems (NYSE:FDS) recently appointed Kevin Toomey as the new Head of Investor Relations, marking a pivotal leadership change that aligns with the company's efforts to enhance communication with stakeholders. Over the past week, FactSet's share price experienced a 3% decline, potentially impacted by broader market dynamics, including a 4% drop in overall market trends. While FactSet's internal changes may reflect strategic shifts, external factors like a technology stock slump and concerns over economic policies also influenced investor sentiment. Major indices such as the Dow Jones and the Nasdaq posted losses, and big tech stocks saw declines amid worries over tariffs and economic slowdowns. Despite the challenges, FactSet's leadership transition signifies a commitment to strengthening investor relations. In the context of a fluctuating market environment, investors often reassess their positions during significant leadership changes and external economic pressures.

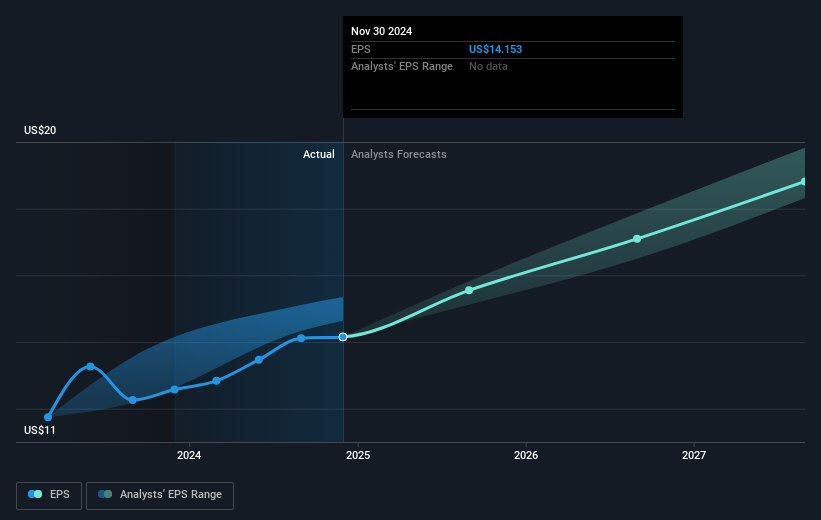

FactSet Research Systems Inc. (NYSE:FDS) has delivered a total shareholder return of 105% over the past five years, reflecting its ability to generate value amidst changing market conditions. The recent developments, including the appointment of key executives like Barak Eilam to the Board and Helen Shan as CFO, reflect the company's ongoing efforts to bolster leadership and enhance governance. Moreover, FactSet's ability to sustain high-quality earnings, with profits growing at an annual rate of 8.3%, has underlined its resilience in the competitive capital markets sector.

Corporate decisions such as steady dividend increases, culminating in a 6% rise to US$1.04 per share, have likely contributed to investor confidence. Another factor is the repurchase of approximately 104,475 shares, amounting to US$48.79 million, which potentially bolstered share value. Integrations, such as the partnership with J.P. Morgan, also present an expanded footprint in financial analytics, which may have reinforced long-term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal