Veeva Systems (NYSE:VEEV) Announces Tina Hunt's Retirement From Board Before 2025 Shareholders Meeting

Veeva Systems (NYSE:VEEV) saw a 6% price increase last week, potentially influenced by the announcement of Tina Hunt's upcoming retirement from the board. This governance change may have reassured investors about the company's strategic direction. While Veeva System's price increase contrasts with a broader market decline of 4%, as major indices like the S&P 500 and Nasdaq Composite suffered from economic concerns, the positive sentiment surrounding its board adjustments likely provided a boost. Other major technology firms experienced declines; Tesla fell 5% and Adobe plunged 13%. This highlights Veeva's resilience amid market volatility. The overall market trend included broader sell-offs and downward pressures, reflecting investor unease over potential economic slowdowns. However, Veeva's specific corporate events and its position within the technology sector may have played a role in securely navigating these challenges, demonstrating investor confidence in its governance and future prospects despite the turbulent market conditions.

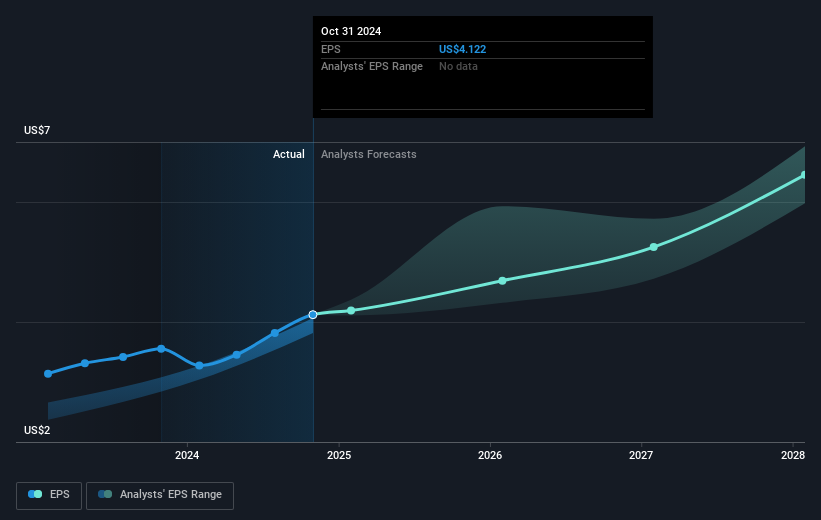

Over the last five years, Veeva Systems has achieved a total return of 66.13%, underscoring its strong performance in the technology sector. This period has been marked by significant developments that likely influenced investor sentiment positively. A key factor was Veeva's robust earnings growth, which accelerated to 35.8% over the past year from an annual average of 15.2% over five years. This momentum was supported by major client announcements, such as Bayer's migration to Veeva Vault CRM, signaling the company's expanding client base. Additionally, Veeva's product launch of CRM Pulse offered enhanced analytics for global healthcare professionals.

Despite these aggressive expansions, Veeva's share price experienced a period of trading below its estimated fair value of US$267.57, signaling market confidence in its growth prospects. Although Veeva underperformed the broader US market, returning just 7.5% over the past year, its outperformance relative to the US Healthcare Services industry— which suffered a 3.3% decline— reflects resilience amid a competitive landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal