Andersons (NASDAQ:ANDE) Has Announced A Dividend Of $0.195

The board of The Andersons, Inc. (NASDAQ:ANDE) has announced that it will pay a dividend on the 22nd of April, with investors receiving $0.195 per share. This makes the dividend yield 1.9%, which will augment investor returns quite nicely.

Check out our latest analysis for Andersons

Andersons' Future Dividend Projections Appear Well Covered By Earnings

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, Andersons' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

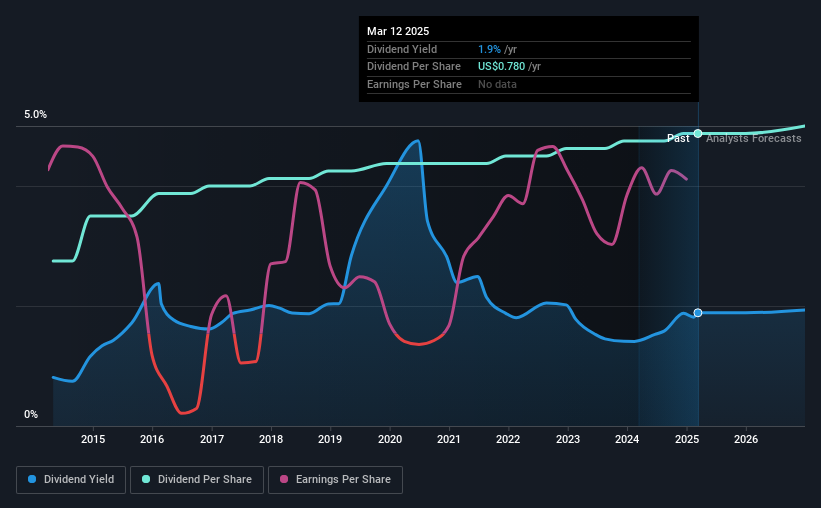

The next year is set to see EPS grow by 44.0%. Assuming the dividend continues along recent trends, we think the payout ratio could be 17% by next year, which is in a pretty sustainable range.

Andersons Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.44 in 2015 to the most recent total annual payment of $0.78. This works out to be a compound annual growth rate (CAGR) of approximately 5.9% a year over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Andersons has seen EPS rising for the last five years, at 73% per annum. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

Andersons Looks Like A Great Dividend Stock

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Now, if you want to look closer, it would be worth checking out our free research on Andersons management tenure, salary, and performance. Is Andersons not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal