Teradyne (NasdaqGS:TER) Names New President for Semiconductor Test Division As Stock Drops 20%

Teradyne (NasdaqGS:TER) recently announced the appointment of Shannon Poulin as President of the Semiconductor Test Division, marking an executive transition ahead of Rick Burns' retirement. Despite the upcoming Analyst/Investor Day that aims to clarify Teradyne's growth strategies, the company's stock experienced a sharp 20% decline last week. This performance is notable against the backdrop of a tech sector rally led by companies like Nvidia and Palantir. While major indexes like the S&P 500 and Nasdaq faced another week of declines, they displayed a brief rebound with strong performances from several tech giants. It appears that broader market trends involving renewed tariff concerns and economic slowdown fears may have weighed more heavily on Teradyne, elongating its recent challenges amidst broader market disturbances.

Over the last five years, Teradyne delivered a total return of 99.92%, reflecting strong long-term shareholder value creation. This period was characterized by several significant events, including the consistent execution of share buyback programs. For instance, in January 2025, Teradyne successfully completed the repurchase of 5.65 million shares, enhancing shareholder returns. The company's strategic focus on semiconductor testing was bolstered by the milestone shipment of the 8,000th J750 test platform in May 2024, showcasing its market leadership in this domain.

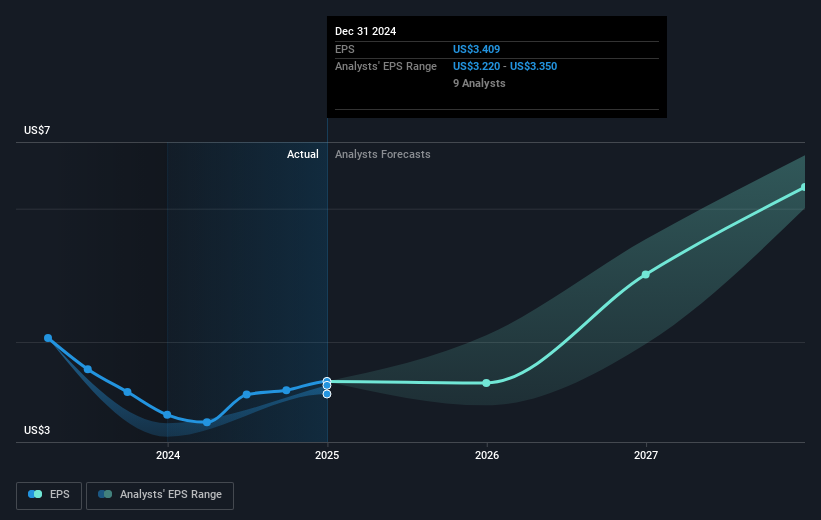

Additionally, Teradyne's financial performance saw substantial growth with the Q4 2024 earnings report revealing a revenue increase to US$752.88 million up from US$670.6 million the previous year. However, despite these positive factors, Teradyne's stock underperformed the broader US Semiconductor industry and market over the past year. The company's earnings growth of 20.9% in the last year outpaced the semiconductor industry, indicating robust operational capability even amid recent challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal