Mastercard (NYSE:MA) Expands Services With ICBA Payments And Jack Henry For Enhanced Banking Solutions

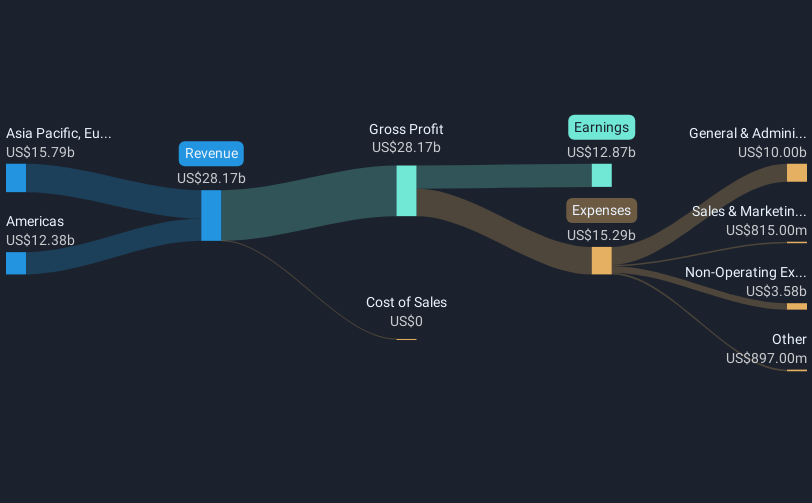

Mastercard (NYSE:MA) experienced a modest share price movement of 0.18% over the last quarter, which was marked by significant developments, including partnerships with ICBA Payments and Jack Henry to enhance and modernize their payment services. These collaborations, aimed at improving customer experience and operational capabilities, reflect Mastercard’s ongoing efforts to maintain its competitive edge. Additionally, its quarterly earnings showed impressive year-over-year growth, with net income rising to $3.3 billion in Q4. This period also saw Mastercard affirming a dividend of $0.76 per share and completing a substantial share buyback that underpins shareholder value. Although the broader market faced volatility and concerns about economic headwinds, particularly evident in the tech sector downturn, Mastercard's steady financial results and proactive strategic partnerships may have played a role in mitigating more pronounced price fluctuations amid broader market turbulence. These factors depict the company's resilience in maintaining investor confidence.

Understand Mastercard's earnings outlook by examining our growth report.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mastercard's shares delivered a total return of 169.14% over the past five years, reflecting robust growth. The company's consistent efforts in expanding its strategic partnerships, such as the collaborations with ICBA Payments and Jack Henry, have been crucial to improving its payment infrastructure. A key highlight was the launch of biometric cards in partnership with Samsung in March 2021, which showcased Mastercard's focus on enhancing transaction security. Additionally, the integration of Mastercard Send into platforms like Nuvei in 2021 broadens the scope for seamless payouts across industries.

Over the same period, Mastercard has also demonstrated strong financial performance, with annual earnings growth at 12.9%. The introduction of new products, like the Bahamas Sand Dollar prepaid card, and their real-time payments platform facilitated by ACI in Peru, reflected their commitment to digital innovation. Moreover, the company's effective use of buyback programs and dividend policies further supports shareholder returns, with notable buybacks completed in early 2025 solidifying its investor appeal.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal