Autodesk (NasdaqGS:ADSK) Engages With Activist Investor And Highlights Strong Financial Performance

Autodesk (NasdaqGS:ADSK) recently responded to Starboard Value LP's move to nominate directors, emphasizing its strong financial position and strategic initiatives, like a new market strategy and restructuring actions. This engagement is part of Autodesk's broader commitment to efficiency and shareholder value, potentially reflecting investors' trust, as seen in a 6.5% price increase last week. Despite mixed overall market performance, with the Dow up slightly and the Nasdaq down, Autodesk's proactive board evolution and financial improvements likely supported its stock performance amidst broader economic uncertainties noted by the Federal Reserve, which opted to not change interest rates due to economic outlook concerns. This context further highlights investor appreciation of Autodesk's advancements in operating margins and free cash flow amidst mixed sector performance, as most tech giants faced declines. Amid these sector headwinds, the company's proactive measures likely resonated positively with investors during the period.

Buy, Hold or Sell Autodesk? View our complete analysis and fair value estimate and you decide.

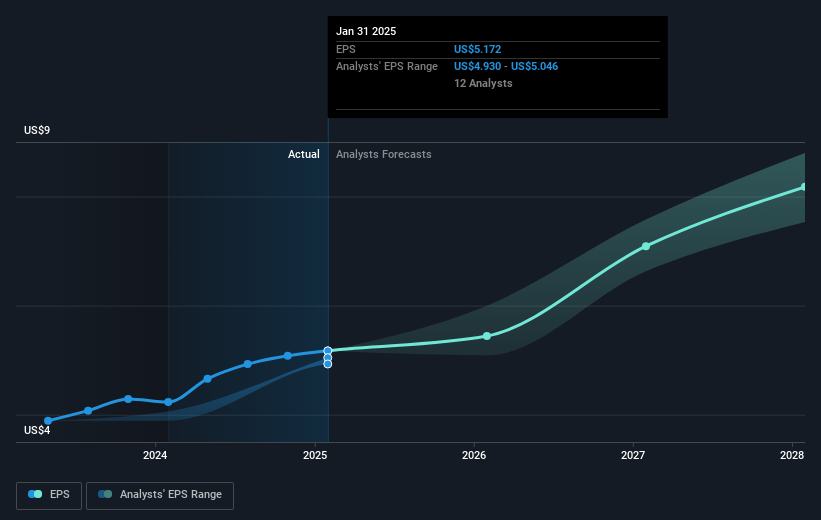

Autodesk's shares have delivered a total return of 78.88% over the past five years, illustrating sustained investor confidence. This performance reflects several critical developments and strategic decisions. For instance, Autodesk's earnings have significantly improved, with a 12.3% annual growth rate, highlighting the company's robust financial health. Additionally, despite a high Price-To-Earnings Ratio, Autodesk remains an attractive investment as it trades at 24.9% below its estimated fair value, potentially appealing to value-oriented investors.

Corporate governance decisions, such as the addition of John T. Cahill to the Audit Committee, have enhanced board oversight, possibly bolstering investor trust. Furthermore, Autodesk completed share repurchase programs worth US$1.12 billion by 2022 and US$414.23 million recently, returning capital to shareholders and supporting share prices. The strategic collaboration with Trane Technologies to improve sustainable building design underscores Autodesk's commitment to innovation and long-term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal