Oracle (NYSE:ORCL) Expands Multicloud Presence with New AI and Database Innovations

Oracle (NYSE:ORCL) witnessed a 3% price increase over the past week, potentially due to several significant developments. The company announced an expanded collaboration with Lloyds Banking Group to enhance customer experience through a multicloud strategy, which included migrating databases to Oracle Database@Azure. Oracle also launched the AI Agent Studio for Fusion Applications and announced the availability of Exadata Database Service on Azure's Exascale Infrastructure in 14 regions. These developments align with broader market trends, as the S&P 500 is on track to snap a four-week losing streak, bolstered by the Federal Reserve's decision to hold interest rates steady.

Buy, Hold or Sell Oracle? View our complete analysis and fair value estimate and you decide.

Over the past five years, Oracle's total shareholder returns have amounted to a significant 226.16%, reflecting robust long-term performance. During this period, Oracle has focused on expanding its cloud capabilities and forged strategic multi-cloud partnerships with major players like AWS, Google, and Azure. This initiative has been vital in transitioning database services to the cloud, driving substantial revenue growth and fulfilling the increased demand for AI and cloud infrastructure.

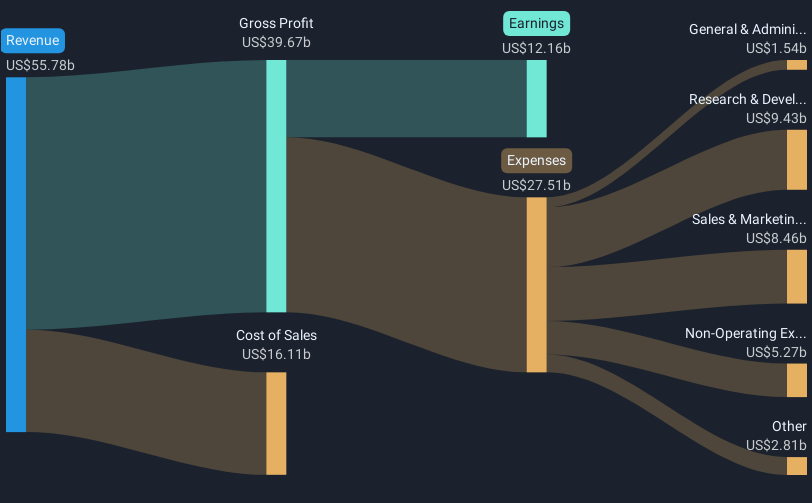

Oracle has strengthened its financial position with consistent earnings growth as demonstrated by its Q3 FY2025 results, where revenue reached US$14.13 billion. Additionally, Oracle's increased investment in infrastructure, aiming to meet the growing need for cloud services, showcases its commitment to sustaining future earnings. These efforts have positioned Oracle to outperform the US Software industry over the past year, which saw a decline, indicating Oracle's resilience and market competitiveness.

Understand Oracle's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal