More Unpleasant Surprises Could Be In Store For V.F. Corporation's (NYSE:VFC) Shares After Tumbling 36%

V.F. Corporation (NYSE:VFC) shares have had a horrible month, losing 36% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

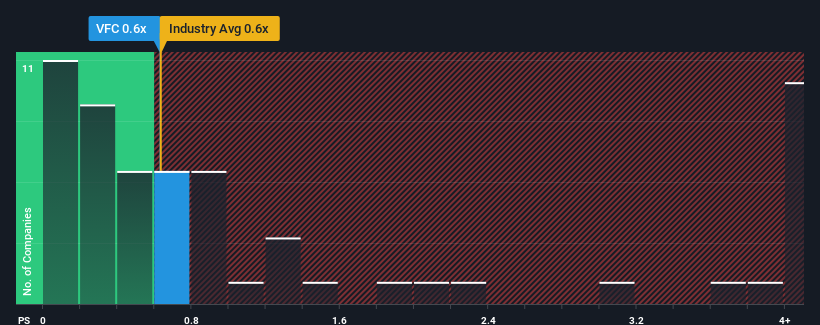

Even after such a large drop in price, there still wouldn't be many who think V.F's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when it essentially matches the median P/S in the United States' Luxury industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for V.F

What Does V.F's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, V.F's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think V.F's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like V.F's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 0.4% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.7% per annum, which is noticeably more attractive.

In light of this, it's curious that V.F's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On V.F's P/S

With its share price dropping off a cliff, the P/S for V.F looks to be in line with the rest of the Luxury industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that V.F's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 2 warning signs for V.F (1 makes us a bit uncomfortable!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal