3 Prominent Stocks Estimated To Be Trading At Discounts Up To 26.9%

As the U.S. stock market experiences fluctuations with recent declines in major indices like the S&P 500 and Nasdaq Composite, investors are closely monitoring economic indicators and policy developments that could signal a potential recession. Amidst this uncertainty, identifying undervalued stocks—those trading below their intrinsic value—can be an effective strategy for investors seeking opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.44 | $34.67 | 49.7% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.12 | $21.95 | 49.3% |

| ACNB (NasdaqCM:ACNB) | $41.35 | $81.98 | 49.6% |

| German American Bancorp (NasdaqGS:GABC) | $37.93 | $75.40 | 49.7% |

| KBR (NYSE:KBR) | $51.43 | $101.34 | 49.3% |

| Smurfit Westrock (NYSE:SW) | $45.57 | $90.04 | 49.4% |

| HealthEquity (NasdaqGS:HQY) | $90.19 | $179.14 | 49.7% |

| Veracyte (NasdaqGM:VCYT) | $33.69 | $66.76 | 49.5% |

| Constellium (NYSE:CSTM) | $11.27 | $22.38 | 49.7% |

| Haemonetics (NYSE:HAE) | $63.35 | $124.46 | 49.1% |

Underneath we present a selection of stocks filtered out by our screen.

Global-E Online (NasdaqGS:GLBE)

Overview: Global-E Online Ltd. operates a platform that facilitates and accelerates direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally, with a market cap of $6.54 billion.

Operations: The company's revenue is derived from its Internet Information Providers segment, totaling $752.76 million.

Estimated Discount To Fair Value: 20.2%

Global-E Online's recent earnings show significant improvement, with sales rising to US$752.76 million for 2024 and a reduced net loss of US$75.55 million. Analysts forecast strong revenue growth at 20.6% annually, outpacing the broader market, and expect profitability within three years. Trading at approximately 20% below its estimated fair value of US$47.92, Global-E appears undervalued based on discounted cash flow analysis while maintaining a positive outlook for future profit growth.

- Our comprehensive growth report raises the possibility that Global-E Online is poised for substantial financial growth.

- Get an in-depth perspective on Global-E Online's balance sheet by reading our health report here.

Somnigroup International (NYSE:SGI)

Overview: Somnigroup International Inc. designs, manufactures, distributes, and retails bedding products both in the United States and internationally, with a market capitalization of $12.01 billion.

Operations: The company's revenue segments include $1.14 billion from international operations, including Sealy, and $3.79 billion from North American operations, also including Sealy.

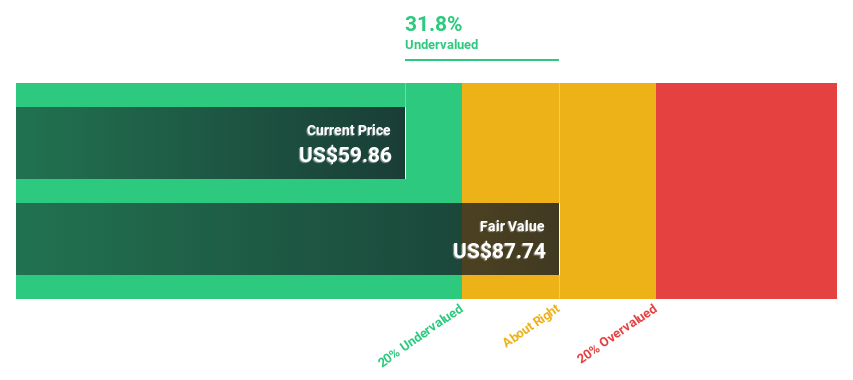

Estimated Discount To Fair Value: 26.9%

Somnigroup International is trading at US$57.5, significantly below its estimated fair value of US$78.67, suggesting undervaluation based on discounted cash flow analysis. Analysts agree the stock price could rise by 25.4%. Despite earnings growth forecasts of 19% annually outpacing the market, recent shareholder dilution and debt concerns remain challenges. Recent inclusion in the S&P Homebuilders Select Industry Index and executive changes may influence future performance positively or negatively.

- The growth report we've compiled suggests that Somnigroup International's future prospects could be on the up.

- Navigate through the intricacies of Somnigroup International with our comprehensive financial health report here.

Zeta Global Holdings (NYSE:ZETA)

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $3.72 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling approximately $1.01 billion.

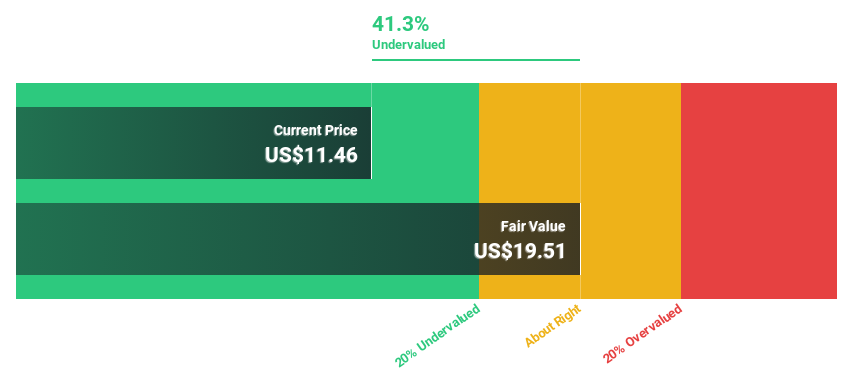

Estimated Discount To Fair Value: 25%

Zeta Global Holdings, trading at US$15.73, is considered undervalued with a fair value estimate of US$20.97, over 20% higher than its current price. The company forecasts revenue growth faster than the US market and expects profitability within three years. Recent earnings showed significant improvement with a net income of US$15.24 million for Q4 2024 compared to a loss previously. Strategic executive appointments aim to enhance growth through AI-driven marketing solutions.

- According our earnings growth report, there's an indication that Zeta Global Holdings might be ready to expand.

- Click here to discover the nuances of Zeta Global Holdings with our detailed financial health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 195 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal