Compañía de Minas Buenaventura S.A.A.'s (NYSE:BVN) 25% Price Boost Is Out Of Tune With Revenues

The Compañía de Minas Buenaventura S.A.A. (NYSE:BVN) share price has done very well over the last month, posting an excellent gain of 25%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

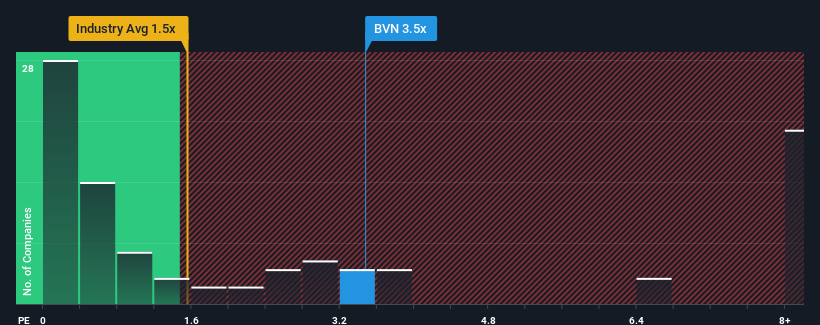

Following the firm bounce in price, when almost half of the companies in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Compañía de Minas BuenaventuraA as a stock probably not worth researching with its 3.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Compañía de Minas BuenaventuraA

How Has Compañía de Minas BuenaventuraA Performed Recently?

Recent times have been advantageous for Compañía de Minas BuenaventuraA as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Compañía de Minas BuenaventuraA will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Compañía de Minas BuenaventuraA's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. As a result, it also grew revenue by 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 6.0% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.9% per year, which is not materially different.

With this in consideration, we find it intriguing that Compañía de Minas BuenaventuraA's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The large bounce in Compañía de Minas BuenaventuraA's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Compañía de Minas BuenaventuraA's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Compañía de Minas BuenaventuraA that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal