Deep Dive Into Air Products & Chemicals Stock: Analyst Perspectives (9 Ratings)

Air Products & Chemicals (NYSE:APD) underwent analysis by 9 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 1 | 0 | 0 |

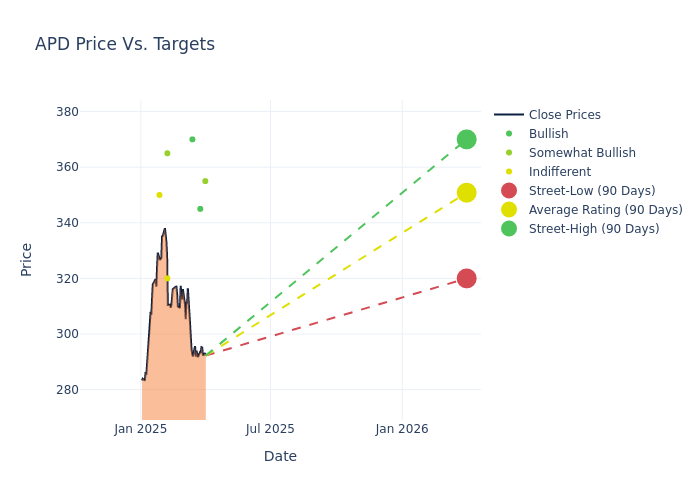

In the assessment of 12-month price targets, analysts unveil insights for Air Products & Chemicals, presenting an average target of $356.11, a high estimate of $385.00, and a low estimate of $320.00. Witnessing a positive shift, the current average has risen by 0.22% from the previous average price target of $355.33.

Decoding Analyst Ratings: A Detailed Look

The standing of Air Products & Chemicals among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Duffy Fischer | Barclays | Lowers | Overweight | $355.00 | $365.00 |

| Patrick Cunningham | Citigroup | Lowers | Buy | $345.00 | $373.00 |

| Joshua Spector | UBS | Lowers | Buy | $370.00 | $395.00 |

| Michael Sison | Wells Fargo | Raises | Overweight | $365.00 | $350.00 |

| Jeffrey Zekauskas | JP Morgan | Lowers | Neutral | $320.00 | $345.00 |

| Joshua Spector | UBS | Raises | Buy | $385.00 | $375.00 |

| Steve Byrne | B of A Securities | Maintains | Neutral | $350.00 | $350.00 |

| Duffy Fischer | Barclays | Raises | Overweight | $365.00 | $315.00 |

| Michael Sison | Wells Fargo | Raises | Overweight | $350.00 | $330.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Air Products & Chemicals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Air Products & Chemicals compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Air Products & Chemicals's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Air Products & Chemicals's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Air Products & Chemicals analyst ratings.

Get to Know Air Products & Chemicals Better

Since its founding in 1940, Air Products has become one of the leading industrial gas suppliers globally, with operations in 50 countries and 19,000 employees. The company is the largest supplier of hydrogen and helium in the world. It has a unique portfolio serving customers in a number of industries, including chemicals, energy, healthcare, metals, and electronics. Air Products generated $12.1 billion in revenue in fiscal 2024.

Air Products & Chemicals's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Decline in Revenue: Over the 3 months period, Air Products & Chemicals faced challenges, resulting in a decline of approximately -2.2% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Air Products & Chemicals's net margin excels beyond industry benchmarks, reaching 21.06%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Air Products & Chemicals's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.66%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Air Products & Chemicals's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.55%, the company showcases efficient use of assets and strong financial health.

Debt Management: Air Products & Chemicals's debt-to-equity ratio is below the industry average. With a ratio of 0.91, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal