Southern Copper (NYSE:SCCO) Shows Resilience Despite Market Volatility

Southern Copper (NYSE:SCCO) saw its stock price experience very little movement, increasing by just under 1% over the last month, during a period marked by heightened market volatility due to global trade tensions. While Southern Copper navigated this challenging market situation, major indexes like the Dow Jones and Nasdaq faced significant declines due to new tariffs announced by the Trump administration. Despite the broader market downturn, which saw significant losses in tech and manufacturing stocks, the company's stock remained stable. This resilience against such a turbulent market backdrop highlights the steadiness of Southern Copper during these uncertain times.

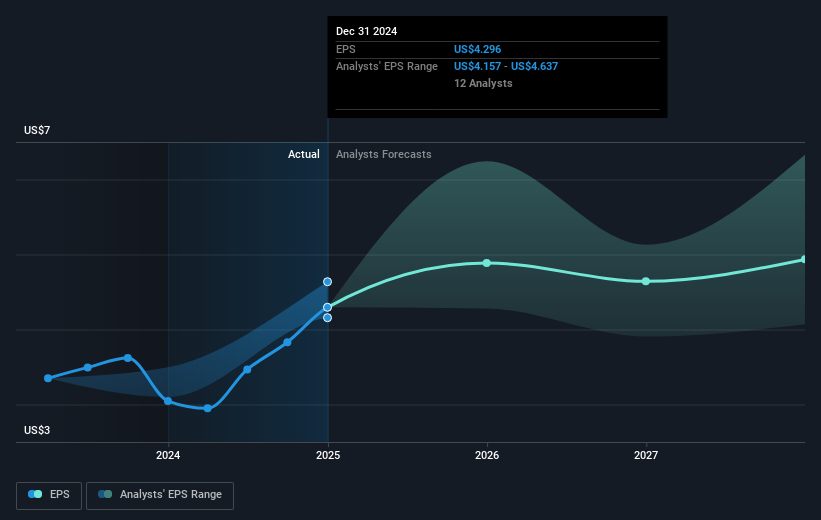

Over the last five years, Southern Copper's total shareholder returns reached 256.17%, reflecting robust growth. This impressive performance is underscored by key developments such as the rapid ramp-up of the Buenavista Zinc concentrator, significantly enhancing zinc production, and the expansion of their Peruvian operations, contributing to record sales of US$11.43 billion in 2024. The company also improved net profit margins, from 24.5% to 29.5% between 2023 and 2024, supporting profitability.

Despite these accomplishments, Southern Copper underperformed the US Metals and Mining industry and the broader market over the past year, focusing investor attention on the challenges posed by regulatory risks and increasing operating costs. Yet, with initiatives like the Tia Maria and El Pilar projects aiming for long-term scalability, the company continues to pursue growth. The dividend policy, with a consistent quarterly cash dividend culminating in US$0.70 per share in early 2025, further highlights its commitment to returning value to shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal